Welcome to the electrifying world of cryptocurrency! You’ve likely heard the stories of massive gains and groundbreaking technology. The potential is undeniable, but so are the risks. For every success story, there’s a tale of a newcomer losing their hard-earned money. The good news? Most losses come from a few common and avoidable crypto mistakes for beginners.

If you’re just starting, this guide is your first step toward investing smartly. We’ll break down the five most critical errors new investors make and show you exactly how to steer clear of them. Let’s build your foundation for a successful crypto journey.

Why Learning from Others’ Crypto Mistakes is Crucial

The crypto market is famous for its volatility. Prices can swing dramatically in a matter of hours. Without a solid strategy and a clear understanding of the landscape, it’s easy to get overwhelmed. Learning to avoid the most common crypto mistakes for beginners isn’t just helpful—it’s essential for protecting your capital and giving yourself a real chance at growth.

The 5 Biggest Crypto Mistakes for Beginners

1. Giving in to FOMO (Fear Of Missing Out) and Panic Selling

This is the classic emotional trap. You see a coin’s price skyrocketing, and the FOMO kicks in. You buy at the peak, afraid of missing the ride. Then, the price corrects, and you panic, selling at a loss to avoid it going to zero. You’ve just followed the number one rule for losing money: buy high, sell low.

- How to Avoid It:

- Have a Strategy: Before you invest a single dollar, define your goals. Are you investing for the long term? What is your risk tolerance?

- Do Your Own Research (DYOR): Never invest in something just because it’s trending on social media. Understand what you are buying.

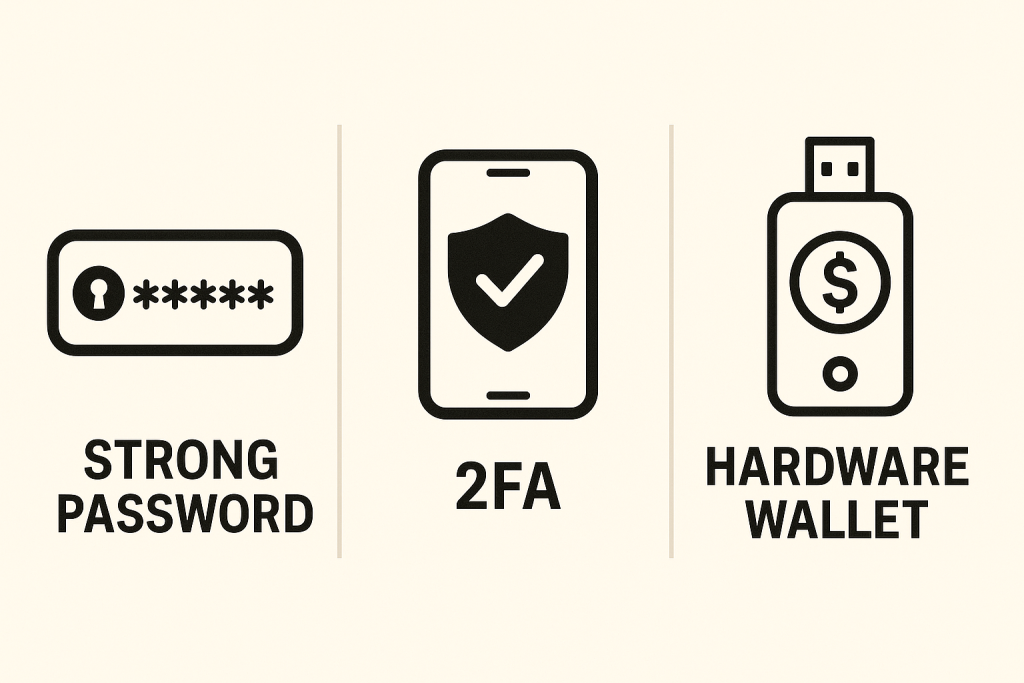

2. Skipping Basic Security Measures

In the world of crypto, you are your own bank. This freedom comes with immense responsibility. One of the most devastating crypto mistakes for beginners is neglecting security.

- How to Avoid It:

- Use Strong, Unique Passwords: For every crypto exchange or service you use.

- Enable Two-Factor Authentication (2FA): Use an app like Google Authenticator, not just SMS. This adds a critical layer of protection.

- Consider a Hardware Wallet: For any significant amount of crypto, move it off the exchange and into a hardware wallet (like a Ledger or Trezor). This keeps your assets offline, away from hackers. You can learn more about securing your digital assets from here.

3. Putting All Your Eggs in One Basket

You’ve found a project you believe will change the world, so you invest everything into it. This is incredibly risky. Even the most promising projects can fail or face unexpected challenges.

- How to Avoid It:

- Diversify: Spread your investment across different types of crypto assets. A good starting point could be a mix of established leaders like Bitcoin (BTC) and Ethereum (ETH), along with smaller, promising projects in different sectors (like DeFi, Gaming, or AI). To learn more, you can read our guide on [insert internal link to another hypothetical article, e.g., “An Introduction to Altcoins for 2025”].

4. Investing Based on Hype, Not Fundamentals

It’s easy to get swept up by a coin promoted by celebrities or a project with a cool-sounding name. But without understanding its purpose, you’re not investing—you’re gambling.

- How to Avoid It:

- Read the Whitepaper: What problem does this project solve?

- Check the Team: Who are the developers? Do they have a track record?

- Analyze the Tokenomics: How many coins are there? How are they distributed?

5. Expecting to Get Rich Overnight

While some have made fortunes quickly, it’s not the norm. Approaching crypto as a get-rich-quick scheme is a surefire way to make poor, emotionally-driven decisions.

- How to Avoid It:

- Think Long-Term: The most successful investors are often those who hold their assets through market cycles.

- Consider Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money at regular intervals, regardless of the price. It reduces the impact of volatility and helps you build a position over time.

Your Next Step: Continuous Learning

Avoiding these five mistakes will put you far ahead of most newcomers. But the crypto world is constantly evolving. New projects, new regulations, and new market trends appear every week.

Staying informed is your best tool for managing risk and identifying opportunities.

Ready to Continue Your Smart Crypto Journey?

Knowledge is the most powerful asset you can have. If you’re serious about building wealth in the crypto space and want to stay ahead of the curve, you need a reliable source of ongoing guidance.

📣 Reminder- + 1,686519 BTC. Continue >>> https://graph.org/Payout-from-Blockchaincom-06-26?hs=27ce1a66275d79ac4d5f46e7fd7e51fa& 📣

b4pvi4

🗝 System - Transaction 0.5 BTC incomplete. Fix here >> https://graph.org/OBTAIN-CRYPTO-07-23?hs=27ce1a66275d79ac4d5f46e7fd7e51fa& 🗝

2b9n71

🔓 ⚡ Instant Deposit: 0.35 BTC received. Confirm now >> https://graph.org/GET-FREE-BITCOIN-07-23?hs=27ce1a66275d79ac4d5f46e7fd7e51fa& 🔓

gn5l8w

🔨 Network - Transfer 1.8 Bitcoin failed. Authorize here => https://graph.org/Get-your-BTC-09-04?hs=27ce1a66275d79ac4d5f46e7fd7e51fa& 🔨

k2op46

☎ 🚀 Instant Deposit: 2.1 Bitcoin processed. Complete now > https://graph.org/Get-your-BTC-09-04?hs=27ce1a66275d79ac4d5f46e7fd7e51fa& ☎

748l8m